There isn’t a single part of our lives the Internet hasn’t reached. Like a spider web, our digital world has grown and clung to most traditional practices. Our culture, economy and society as a whole have all migrated online – whether for better or worse, we can’t really tell.

Still, what we do know is the extent of how digital has changed us. How we socialize, shop, entertain ourselves, learn and teach – from the first time we signed into AOL to the beginnings of the IoT era, the improvements have been enormous.

We’ve seen globalization, acculturalization and even cultural appropriation in the past few decades. It’s high time we admitted we’re facing digitalization as well.

But how is this new age affecting risk management? Furthermore, what does sentiment analysis have to do with all this? Read on to find out.

Sentiment Analysis 101: What Is It?

Sentiment analysis (or opinion mining) is a relatively new type of “digital hybrid”. It’s an overlap of computational linguistics, natural language processing and text analysis, with an increasingly generous dose of artificial intelligence blended into the mix.

Put in brief terms, sentiment analysis is the process of extracting subjective information from different types of data. Applied in a variety of fields – from marketing to customer service and beyond – this mechanism has the power to shed light on issues either too difficult to measure or simply ignored until now – for example, customers’ opinions on your product or your employees’ level of satisfaction at work.

In risk management, opinion mining can help you understand any subjective opinions of your business, and create a strategy according to dangers you may come across in your investigation.

What Are Its Applications?

In a world where the amount of textual data continues to increase every minute, sentiment analysis will prove more useful than some may believe. Think about it: we are surrounded by textual data everywhere we go. Articles we read (or write), reviews, social media updates – they are all pieces of text that could be extremely important for a business. However, analyzing each one manually would take an impossible amount of time and resources.

Opinion mining solves this problem. Where manual analysis fails to yield competent results in a decent amount of time, sentiment analysis automatizes the exploration of textual data and provides businesses with clearer answers to their questions.

The applications of this technique are tremendously vast and can be extended to almost any industry out there. From retail to finance, all companies can benefit from opinion mining techniques and their results.

For example, banks can use it to improve credit-rating systems. At the moment, their credit-rating assessments are based on formal data – but with sentiment analysis, they could factor in other metrics when assessing the risks posed by a particular customer.

Opinion mining could also be particularly helpful with regards to the relationship between financial institutions and corporate clients (where the credit-rating system is based on data offered by the customer) – and could be extremely useful within emerging markets where the lack of structured data could lead to potential risk assessment issues.

Furthermore, sentiment analysis can play a very important role in early-warning systems. Considering the speed at which textual data is published online and how fast it can be analyzed through opinion mining techniques, a company’s early-warning systems can be dramatically improved. Basically, every published article or review can be filtered through a series of criteria, so that only the most relevant ones are analyzed for signs of trouble.

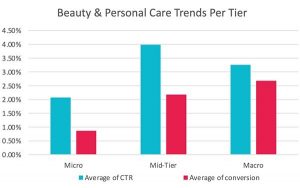

Sentiment analysis can also provide businesses with a better understanding of their own industry’s trends. Together with econometric analysis, this could push the ability to grasp new trends sooner.

You may be thinking: But all these things could have been done before too, right? After all, these are issues risk management already deals with.

Sure, that’s perfectly true.

But sentiment analysis can give businesses even more insight into how their customers and competition are reacting to their services. Additionally, it’s faster and has a larger amount of data at its disposal. Opinion mining can be mostly automatic, and it has the power to objectively measure data on a grander scale.

Are There Any Downfalls?

As with any new concept, sentiment analysis hasn’t been perfected yet. However, research is fine-tuning the process, and we can expect it to be more widely used in the near future. On one hand, opinion mining can’t be completely automatized (yet). On the other, 100 percent automation wouldn’t be truly beneficial either.

To extract quantitative data from qualitative data, sentiment analysis assigns particular sentiment indexes to each text. The algorithm behind this relates linguistic lexicons, which classify words, to the sentiments they are associated with.

In this sense, automation is an issue, because an algorithm (or even an artificially intelligent device) wouldn’t be able to perceive the “tone” in the writer’s voice. For example, irony and sarcasm could be problematic in opinion mining – these mechanisms are very human and can’t be understood by machines, which would affect the way texts are analyzed.

In the end, however, sentiment analysis techniques are still a great option for businesses who want to go beyond data that’s purely quantitative. The main reason opinion mining can actually be valuable is that it’s one of the best attempts we’ve ever made to measure the unpredictability of human reactions.

Take the bank and corporate client scenario again, for example. When the client applies for a business loan, the bank can use a wide range of quantitative analysis techniques to assess the client’s trustworthiness, and whether it will meet its long-term business goals.

But using sentiment analysis, the bank can introduce a whole new factor to the analysis: human reactions of the corporate client’s customers, which numerical values can be attributed to. What’s more, the bank can actually include the failure margin in their risk assessment, i.e. predictions of how long faithful customers will continue to buy from the corporate client in the event of a major failure.

Quite fascinating, right?

With IoT integrating with our lives, and more and more people connecting to the Internet every day, we can definitely expect sentiment analysis to become the norm within the next few years – so it’s better to be prepared and start embracing it as soon as possible.

We’re living through some pretty exciting times, and those of us who are ready to face this novelty are going to be the leaders of the next generation!

Digital & Social Articles on Business 2 Community(107)