Whoa! Is it really November? We will be in a sprint over the next few weeks to wrap-up projects, get our budgets in order for year-end and to solidify 2017 planning. I asked my Head of Marketing what has her counting sheep at night as we head into the New Year. These areas shouldn’t be surprising:

Better leverage data and analytics to drive advisors to act

Maintain relevance in an increasingly digital world

Break through the clutter

I have had the opportunity to sit down with a number of firms over the past few months and this is relatively universal. More than ever, we are being tasked to do more, with less; improve validation of marketing ROI and a deeper collaboration with our distribution teams – to have a great impact on business goals. We have excellent consultants and partners, like kasina and Cogent, that provide valuable insight but to incorporate their findings, we need to look at our customer holistically to enrich our relationship with financial advisors. To quote Morningstar’s Behavior Science Head, Stephen Wendel, “If you want Advisors to take action, how do you help them?”

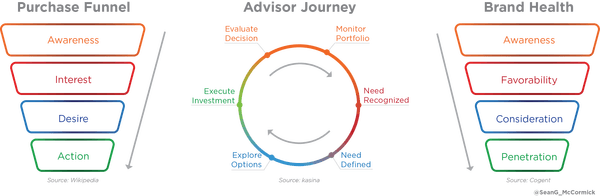

Figure 1

The common ground with Marketing and Sales teams lies within the Purchase Funnel and Brand Health, but this does not align with the advisors’ journey. To provide context, the “Purchase” principal was first published in 1898. Fundamentally, we are programmed to move our audience “down the funnel” while the customer journey is circular [Figure 1].

Figure 2

Internally marketing and sales are collaborating closer than ever due to the arrangement of priorities, but this is not on mutually aligned for our audience. This variance contributes to the complexity of leveraging data and analytics to drive advisors to act. At a high level, we sit in the middle [Figure 2], trying to identify where any given advisor is in their journey at one side of the spectrum and qualifying this information for our Sales team on the other side. Until we all stand on common ground, there will be a barrier in leveraging engagement data to drive advisors to act. We first need to consider dropping the “funnel”; look at the decision process in circular manner and not have an intense emphasis on moving an advisor down the funnel.

Another fundamental hindrance at advisor engagement is our focus on “campaigns” and their extent in “plan, build & run.” When tied to large campaigns, it forces teams into being narrowly focused on solving for a specific need over lengthy periods. While centering on key insight is important in driving awareness and favorability, but if you aren’t contributing value to the rest of the journey, it limits the ability to heighten influence on consideration and/or penetration of the advisor. We can’t forget to map your current marketing mix to what we are planning to build and how it serves the customer journey. Building a large campaign, just because it addresses a single need, doesn’t make a brand relevant universally. Maintaining relevance is being able to serve the whole journey, not one step, very well. Not diversifying content, leaves a brand susceptible in being dropped from the advisors’ journey.

Yet, the complexity in all of this is trying to identify where an advisor is in their journey and what that means to the Brand and Sales. Due to the fact their decision process over a great number of clients. They can be in various stages of the journey at any given time, dependent on client. I believe this is drastically overlooked. With this holistic perspective, you can view Brand Health and the Purchase Funnel on common ground with an advisors’ journey. Then layering on a marketing mix, to retain a single perspective. To break through the clutter, isn’t necessarily just about having timely content in regards to the topic but goes back to maintaining relevance to their process by providing what is the most appropriate “next best action” to qualify and concurrently serve content to transition with the advisor to the next stage in their decision process. What I take from this view is building marketing programs that can meet the needs at each step follow the journey and is essential to be able effectively progress with needs.

Yet, the complexity in all of this is trying to identify where an advisor is in their journey and what that means to the Brand and Sales. Due to the fact their decision process over a great number of clients. They can be in various stages of the journey at any given time, dependent on client. I believe this is drastically overlooked. With this holistic perspective, you can view Brand Health and the Purchase Funnel on common ground with an advisors’ journey. Then layering on a marketing mix, to retain a single perspective. To break through the clutter, isn’t necessarily just about having timely content in regards to the topic but goes back to maintaining relevance to their process by providing what is the most appropriate “next best action” to qualify and concurrently serve content to transition with the advisor to the next stage in their decision process. What I take from this view is building marketing programs that can meet the needs at each step follow the journey and is essential to be able effectively progress with needs.

To answer the needs of my Head of Marketing:

Better leveraging data and analytics to drive advisors to act is using the engagement data to determine at that given time, where they were in their journey and if our marketing successfully transitioned –where did the advisor engagement stop and why. Take those learnings, and adjust accordingly.

Maintaining relevance in an increasingly digital world can be achieved by having diversity in your marketing mix based on the customer journey versus large campaigns focused on single needs.

Breaking through the clutter is maximizing engagements by building programs to help advisors act –calculated CTA’s and applicable remarketing/automation focused on the decision process.

While Google has recently used “micro-moments” to discuss a consumers’ decision journey, but this stands true with advisors. Since the advisor can be at different stages of their journey, at any given moment, their needs are rapidly changing. To shift to this approach, will require change. This change can be started in 2017 by challenging your marketers to take this holistic view during strategic planning and ensure the tactical execution has the structure to join your advisors in their journey and enrich these relationships.

Business & Finance Articles on Business 2 Community(196)