— April 23, 2018

Fotocitizen / Pixabay

Proper market research is the stable launching pad to rocket any successful product, service, or campaign. That’s not rocket science.

Having said that, market research tends to get overlooked in the event space. All too often, brands get lulled into the “we’ve always done it this way” mentality when it comes to the annual exhibition. It’s time to dust off the usual signage, call an event provider for a booth, and send out the team with product samples. Or something like that.

Any event should be well-researched, new or reoccurring. Face-to-face marketing is still crucial. Research shows that companies are increasingly investing in events for their ability to bring results (some as much as 50% of marketing budget).

Without the right data, you risk exhibiting at an event with the wrong audiences. Your service or product will sputter. Conversely, well-researched shows blast your brand to hyperspace when it comes to customer engagement.

Follow this approachable and executable roadmap below to find the most suitable trade show or exhibit for your product or service.

Align the needs of your brand

One of the most important questions for marketing and business decisions is “Why?”

Why does your organization need to be at an event? At any event?

For these answers, it’s key to interview internal sales, marketers, product managers, and other stakeholders. This search aims to obtain background on promotional aims, product details, and competitive climate needed to select shows that fit like the proverbial glove. If possible, getting upper management to present a “big picture” vision goes a long way — which can then be aligned with the specific goals of having a booth (sales, networking, data gathering, product testing, etc.).

After a thorough examination, you’ll acquire a solid picture on identifying events that line up with your organization’s general marketing aims. Not getting this right from the start is likely to imbalance the rest of the process — so be as thorough as possible!

Find out where your audiences hang out

It may seem obvious to know what events your audience frequents, but it’s also vital to know why they attend a show, as well as their specific opinions after experiencing an event. After all, there can be many events for a single vertical and many reasons audiences attend them (education, networking, product search, etc.). Some events are more popular or relevant in any given year.

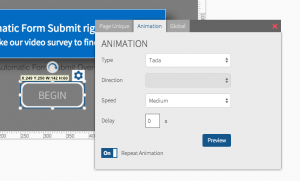

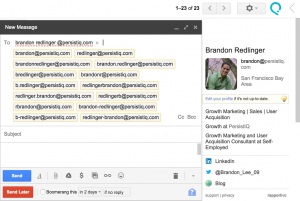

This is the time to whip out a survey for your customers and prospects. Ask them which events they patronize yearly, what are they looking for specifically on the show floor, and other explorative questions. Not every organization has the budget or time for high-level surveys, but in full transparency, QuestionPro provides its clients with a suite of intuitive research tools that can do the trick.

Keep in mind that informal, qualitative studies like picking the brain of clients over lunch or during a phone meeting can go a long way in obtaining data.

Hunt down the right exhibition or trade show

You’ve got actionable data at this point. Yay! Now it’s time find the best event opportunities for exhibiting. Luckily, there are many sources for identifying potential events.

These include:

- Association websites

- Trade publications

- Internet sites

- Trade associations

- Competitors (specifically their sites or social media channels)

- Direct mail from event producers

This investigation should produce a list of shows that match your brand’s marketing strategy and objectives. For best results, categorize by industry, vertical, and market — at the same time analyzing for potential cross-overs for multi-product/division companies.

Go into the belly of the beast

With a targeted list in your possession, contact organizers of each relevant show for pertinent information. This can include attendance figures, cost per square footage, space availability, sponsorships, etc. In addition, try to contact current exhibitors for their personal experiences.

As a warning, this step may be difficult. In many cases, organizers just don’t possess the kind of data you require, are reluctant to share numbers publicly, or have inadequate standards of information-reporting. What’s more, many show organizers simply lack independent auditors to certify their own data. Regardless, any information collected will go miles towards achieving research goals.

For additional criteria, there is nothing wrong with weighing such elements as speaker popularity, media exposure, or brand recognition. Not every event can be Comic-Con or SXSW, but you can hear an industry buzz if you’re attentive.

Use your research!

Now that you have all this rich data, it’s time to do something about it.

By now, you should have a clear answer to the most critical question: Should we exhibit and where?

Even if the answer is yes to exhibiting, it’s a matter of to what extent and how deep to invest. All of this depends primarily on the target audience quantity and quality (gleaned from the show organizer data and your surveys). It also depends on the feedback and insights of all relevant company stakeholders and decision-makers

Put together, this process ought to lead to a full marketing strategy after a few meetings. Even better, you’ll likely find overarching objectives and strategies for future shows, not to mention post-participation promotions.

What’s important is that your organization can be free of that “we’ve always done it this way” attitude when it comes to exhibiting. Once on the show floor, your team will be saying a hearty “hello” to audiences that are ready to interact with your brand fully.

Business & Finance Articles on Business 2 Community

(74)