— September 11, 2019

What is a Buy and Hold Investor?

A Buy & Hold Investor is a long-term investor who wants to accumulate assets and income over a 10 to 40-year time frame, with the minimum of effort.

In recent times Buy & Hold has become unfashionable, with the get rich quick culture preferring to enjoy the adrenaline of day trading with highly leveraged Foreign Exchange (Forex) or contracts for difference (CFD’s) with the idea that they will get rich quick.

On the whole, this is a myth for 95% of people, who wipe out there investments within a year or two.

Buy & Hold Investors Always Win Over The long-term.

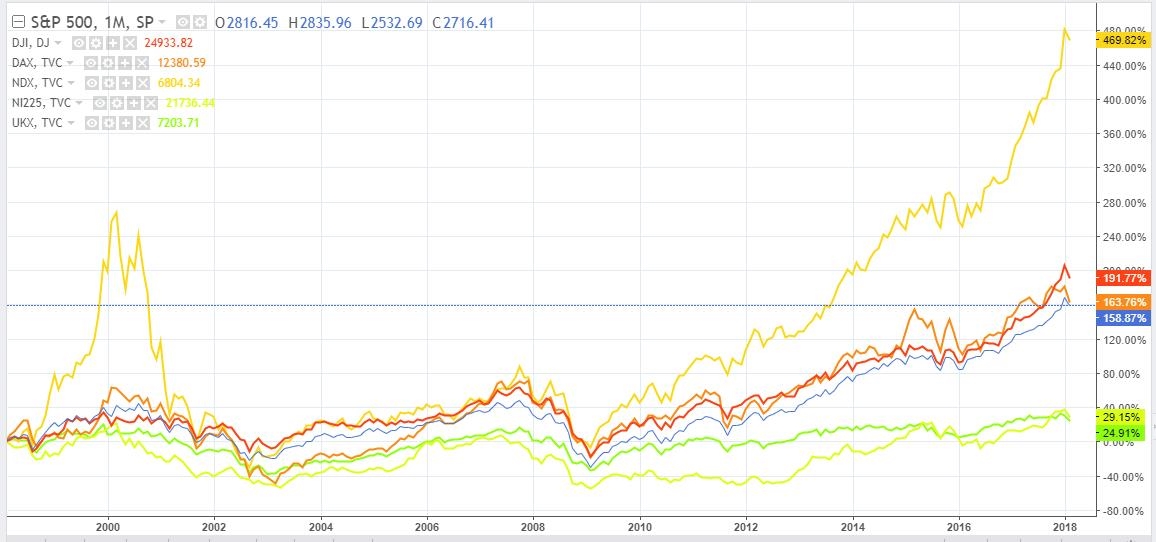

There has never been a 20 year period since 1945 where a Buy & Hold Investor has not made significant gains, if investing in a developed index, like the Dow Jones Industrials, the S&P 500 or even the higher-performing Nasdaq. Source

20 Year Stock Market Returns – S&P500 vs, DJIA vs Nasdaq vs Nikkei 225 vs UK FTSE 100 vs German DAX @LiberatedStockTrader.com

However, you need the mindset to Buy and Hold even through economic downturns and crises. As a young investor time is definitely on your side and this is your key advantage.

No one really talks about Buy & Hold because brokerages want you to buy & sell often so they get more trading commissions.

5 Key Advantages of a Buy and Hold Strategy

1. Compounding.

If you set aside a regular amount every month to invest in an Index Tracker or Index ETF, when the prices are higher you buy fewer stocks, and when prices are lower you get more stocks for your money. Compounding this over the long term brings better returns

2. Dividend Income.

If you invest in dividend stocks you can also receive a steady quarterly cash income which usually remains constant despite the current state of the stock market or the stocks price.

3. Dividends with Tax Benefits

Buying dividend stocks and holding for the long term means you will pay less tax as your dividends will be “Qualified” meaning they qualify as Capital Gains Tax, not income Tax, meaning at the lowest tax band a tax of 0%. We all like Zero Tax.

4. Dividend Reinvestment Plans (DRIPS)– many companies offer a dividend reinvestment plan where you can reinvest your dividends for more shares, get a discount on extra shares you buy and even defer tax for 20 years, or until you sell the stocks. Right and Wrong Time to Start. Of course, it would be ideal to start your investing at the bottom of a market crash, but contrary to popular belief, no one knows when that truly is. So, really any-time is good to start. If you invest at the top of the market and it crashes, your next monthly investment will buy stocks at bargain prices.

5. Lower trading costs

The less you buy and sell stocks, the lower your costs will be. Most brokers charge at least $ 4 per trade. If you are buying and selling stocks on a yearly basis this cost is negligible. However, if you are trading stocks on a daily or weekly basis the costs can be astronomic.

As you can see the entire system is set up to enable and encourage you to invest for the long-term, and even enjoy tax benefits. Day trading is a high risk, high trading fees game with tax disadvantages.

This is ultimately why Buy & Hold long-term investing is still cool.

Original article published here.

Business & Finance Articles on Business 2 Community

(40)