Resolve customer data debt and let your enterprise harness the power of CDPs for improved marketing outcomes.

Only half a decade since getting labeled as a marketplace, customer data platforms (CDPs) remain a hot topic in martech and for a good reason. Who doesn’t want to empower marketers and other customer experience specialists with easy access to rich, accurate customer data?

Yet at Real Story Group, we see CDPs entering a kind of sophomore slump. Symptoms abound:

- Difficult initial “MVP” deployments, as enterprises struggle to deal with core issues of data availability and quality, as well as identity resolution blockers.

- Stunted roll-outs, where enterprises lack the resources to broaden a CDP footprint beyond a single use case.

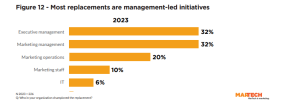

- Surprising number of CDP vendor replacements, now constituting nearly half of our CDP vendor selection advisory work.

Clearly, something is going on. One part of the organization feels more than ready to reap the manifold benefits of a CDP, such as better targeting and paid media efficiency, omnichannel personalization and more.

But there’s another part of the organization that’s not so ready. It’s not their fault, but a history of underinvestment means they’re shielding something big: customer data debt.

What is customer data debt?

You’ve probably heard of technical debt, where a series of tactically expedient coding shortcuts leads to the progressive accumulation of long-term difficulties with platform maintenance and enhancement – difficulties measurable as “debt” and, therefore, requiring a pay-down to resolve.

Customer data debt (CDD) is surprisingly similar. Enterprises spend years building up a lot of data around customers, but not necessarily about customers. When the time comes to treat that person like, well, a person, you might only have recourse to a disconnected collection of random behaviors and profile attributes that may or may not align with the same individual. Uh-oh!

Ironically, born-digital firms are some of the worst offenders. Looking to grow quickly, they accumulate transaction records and develop systems designed to enable financial reporting, typically around sales and costs – key metrics when pitching investors. But when the time comes to perform more thoughtful lifecycle marketing, cross-sell new products or resolve marketing-sales-service friction that’s hurting your NPS scores, leaders look for a “single view of the customer” that frequently doesn’t exist.

In retrospect, it seems obvious: after treating customers as the object of your business data grammar, you can’t suddenly turn around and make them the subject. Today, many enterprises do not yet deploy a single universal customer ID.

Sadly, the enterprise data ops team often sits on the wrong end of an accusing finger. “Why didn’t you think of this,” business execs will ask. “Why didn’t you fund this three years ago,” data teams will retort. Neither is to blame; both will have to cooperate to resolve it.

Established players like insurance companies can also suffer from CDD. For compliance reasons, they’ve likely resolved customer identities, perhaps via a master data management regime. Yet they often lack the ability to leverage crucial customer interaction data, so their digital customer experiences can feel stilted and impersonal.

Alas, it frequently never occurs to budget-holders that this debt needs to get paid down amid more pressing – usually more near-term – martech initiatives. But then the consequences arrive.

When you don’t pay it down

Most digital, marketing and CX transformation initiatives assume — perhaps naively — that the enterprise knows all about its customers, with front-line staff and systems readily accessing a full “Customer 360.”

But if you suffer from CDD, you’re likely going to face the following:

- No Customer 360, which means you don’t know:

- If you have access to all relevant actionable data sources or not.

- How to consolidate siloed customer data so you can get a truly full picture.

- If you have access to all relevant actionable data sources or not.

- Unusable Customer 360, where you don’t know:

- Whether three potentially linked records are actually the same person, so you can’t confidently send them a specific offer.

- An individual’s household or business relationships (and vice versa), so you can’t market at a group level.

- An individual’s full interaction history with you, which will get painful for your service reps, among others.

- How different teams and systems have interacted with the customer, slowly eroding your brand.

- Key summary metrics, like the number of message clicks in the past year, which make analytics and campaign planning nearly impossible.

- Whether three potentially linked records are actually the same person, so you can’t confidently send them a specific offer.

- Unreliable Customer 360, which means you don’t know:

- If the data is clean and reliable enough to analyze or activate at all

- Whether the data has been standardized (e.g., it uses M and male for gender or uses different address and phone number formats)

- If the data flows are properly managed to minimize stale data that will make your communications awkward

- If you can handle real-time use cases essential for capturing key moments

- If you are authorized to act on specific customer data points for business, compliance or privacy reasons – so best not to act at all.

- If the data is clean and reliable enough to analyze or activate at all

Many enterprises fall under the misconception that a “CDP” project will solve this. In most cases, it will not. For sure, some CDP vendors reside more on the infrastructure side of the marketplace spectrum and offer technology services for drawing down CDD. But that doesn’t absolve you of the responsibility of doing the actual work — and this work can span years.

The worst case scenario is when an enterprise quite reasonably licenses a more business-oriented CDP that expects to receive a nice pipeline of clean, unified customer data – only to find out that said data actually remains quite discombobulated across multiple different environments. The result? CDP shelfware.

What you should do

All enterprises suffer from CDD. It’s taken a pandemic and an extraordinary profusion of customer touchpoints to shake us all out of a decade of underinvesting in customer data rationalization. The savviest enterprises at least recognize the problem and work on it regularly.

Yet, like all foundational enterprise work, it can be hard to make the business case. This is more of a “cost of doing business” story than a “return on investment” play, at least initially. In my experience, the CMO, CRO, CDO and CIO/CTO need to align here and prioritize the resources required. The most forward-looking leaders always reserve some budget for foundational work; this is one of those cases.

What you may need to do to pay down CDD will vary. But in general, you should cover off on these workstreams:

Get data ingestion in order

This includes collecting key touchpoint data and then investing in cleaning, pipelines, data quality and data modeling. Then, you need to sort out your enterprise customer data model, especially if you have anything more complex than a simple B2C model (think B2B, B2B2C, B2C2B).

Identify any data governance dimensions

Stewardship of data in any Customer 360 environment becomes essential. Among other things, you need to sort out compliance and consent, especially concerning their impact on data enrichment and activation.

Decide where and how to resolve identities

Resolving identities is essential to unifying customer data. You need to decide where you will perform this work, the scope of it and the different techniques you will employ.

Create an agile process converting raw data into actionable attributes

There’s a common misconception that Customer 360 means making available every conceivable data point about a single individual. Instead, marketers need actionable data points that are typically processed or calculated attributes (e.g., how many web visits in the past X months?).

Marketers need new and revised attributes all the time, as quickly as possible, so you need to figure out an agile way to support them

If you’d like to inspire your colleagues on the difference between raw data and actionable attributes, perhaps imagine a Shakespearean couplet:

your customer data lake

doth not a Customer 360 make

Addressing customer data debt for better CDP implementation

Your firm may still benefit from a CDP of some sort. In most cases, you need not postpone that decision process. Again, your CDP may or may not subsume some of those tasks above, this is an upfront architectural decision.

The good news is that you likely do not need to delay your CDP planning significantly. In working with selection teams, we have found that a smart enterprise can draw down CDD, scope and test while choosing a CDP in parallel. Highlighting the dependencies and building a realistic roadmap becomes even easier if you follow an agile selection process.

It feels good to pay down debt! But in this case, it will ultimately be your customers who thank you.

The post Customer data debt: The hidden obstacle to CDP success appeared first on MarTech.

MarTech(3)