— May 14, 2019

£32 million spent on paper receipts and still 50% of the High Street offers no sustainable alternative

- Despite the rising importance of sustainability among consumers, 50% of high street brands still have no paperless option

- Brands that do are utilising customer surveys & social sharing to enhance the customer experience

- Data compliance is clearly top of mind for paperless receipts, yet some brands are falling short

New research by Mailjet has found that 15 of the UK’s top 30 high street clothing labels are failing to offer any kind of e-receipt to customers when shopping within their physical stores.

In the UK, around 11.2 billion receipts are printed each year, at a cost of at least £32 million. Despite the boom in recent headlines around sustainability brought on by David Attenborough’s ‘Climate Change – The Facts’ documentary, it appears that half of UK high street brands and retailers are still reliant on physical receipts for every purchase.

Among the best in class, Uniqlo, Dorothy Perkins and Evans proactively promote sending customers e-receipts via signs or tablets in-store. In all other cases, e-receipts were only sent after the survey testers specifically made the request.

Michyl Culos comments, “Consumers have been making a clear call for the fashion industry to lower it’s environmental costs. Last month, online platform Rent the Runway, allowing people to rent rather than buy their clothes, was valued at 1bn USD. When it comes to the high street, there is room to revitalise methods long considered standard, like paper receipts, and reduce environmental impact by going digital.”

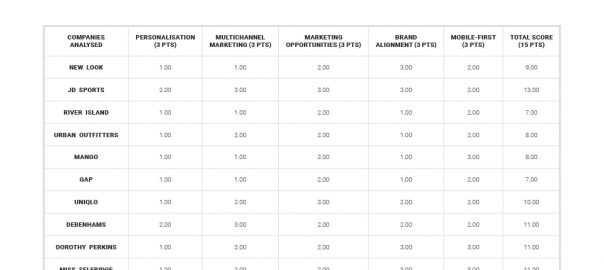

Survey testers opted to receive e-receipts at all 15 stores where they were available. The study then analysed the e-receipt emails received and scored them according to a range of direct marketing metrics including personalisation, shoppability and brand alignment in addition to data privacy compliance.

Sustainability & Consumer Engagement

While many brands initiate the shift to e-receipts for ecological reasons, they are also exploring how else this new format can be leveraged. Every brand tested, with the exception of JD Sports, Mango and Selfridges, included a customer survey within their e-receipts. New Look, Dorothy Perkins, Miss Selfridge, Topshop, Evans, Wallis and Urban Outfitters all offered rewards and incentives in exchange for feedback on the in-store shopping experience.

Many brands also capitalised on the opportunity to direct customers to other marketing-friendly channels. Under the ‘multi-channel marketing’ category, JD Sports scored full marks for including a phone number, email and dedicated support Twitter handle, alongside social media and app links. Debenhams and French Connection also received top marks for including store locators as well as social links.

Michyl Culos notes, “Reducing environmental impact while enhancing engagement with in-store customers is a win-win. It’s clear though that retailers are still in a test-and-learn phase when it comes to determining the best way to leverage e-receipts. For example, some brands use them to encourage customers to post their purchases on Instagram with a hashtag, while others (Uniqlo) offer an incentive for completing a product review on the item purchased.”

Playing By The Rules

A hot topic associated with e-receipts is how to harmonise them with data privacy. This includes clearly informing clients about how their data will be used, but also ensuring they are not automatically opted into any other marketing communications or sent any unsolicited emails for which there is no specific consent or legitimate interest.

Positively, most brands surveyed offered some sort of information regarding the use of the data captured from the customer; with the leaders in this category, Evans, Wallis, Uniqlo and Dorothy Perkins, offering very clear signs or information at store-level. Some brands, including JD Sports, Mango and New Look, also followed up with information in the e-receipt about how data would be used.

Unfortunately for the high street though, a number of brands still did fail to include clear information on data usage in the e-receipt and, in some cases, this information was only provided by asking directly at the till or not provided at all.

More surprisingly, it seems that many marketers still can’t let go of the mindset that the larger your email list is (opted-in or not) the better. The study exposed that some high street brands followed up their e-receipts with unsolicited marketing emails, an activity that might put them at risk of non-compliance with GDPR if brands cannot ensure there is a legitimate interest, that is, a clear link between the email promotion and user’s purchase.

Michyl Culos adds, “Data-compliance when it comes to paperless receipts is a new challenge for retail. It requires awareness and training for both marketers working in head offices and sales assistants who are key in communicating data usage information and registering customer opt in preferences at the point of purchase. Moving to paperless is a large project for retailers, and it would be a shame for them to fall short by simultaneously taking a step forward for sustainability and a step backwards for data protection.”

About the research:

Methodology:

A team of email experts analysed e-receipts sent by 15 leading high street brands and retailers in the UK in March 2019. Each email was individually scored according to how well it met the below criteria, (e.g. scoring system: 3.0 = best possible score, 1.0 = worst possible score) the average result was then calculated for each candidate.

List of brands included in the research (both those who did and did not send e-receipts);

& Other Stories; Berskha; Debenhams; Dorothy Perkins; Evans; Footlocker; Forever 21; French Connection; Gap; H&M; House of Fraser; JD Sports; John Lewis & Partners; Marks & Spencer; Mango; Matalan; Miss Selfridge; Monsoon; New Look; Next Primark; Pull & Bear; River Island; Selfridges; Sports Direct; Topman & Topshop; Uniqlo; Urban Outfitters; Wallis; Zara.

Scoring criteria:

- Personalisation: any evidence of segmentation/personalisation/changed fields based on demographics, location, ect.

- Multichannel Marketing: social media buttons, redirecting to mobile app or website content, mixing online/offline – in-store actions.

- Marketing Opportunities: e-receipt includes additional marketing initiatives (which have legitimate interest), including surveys.

- Brand Alignment: strong imagery, brand voice, consistency with website.

- Mobile-first: email is viewed on a desktop, mobile and tablet device and scored according to whether it is responsive and how well the design works across formats.

Also measured – Data Privacy Compliance: clear information on how the data would be used and no forced opt-ins to marketing emails.

Business & Finance Articles on Business 2 Community

(36)