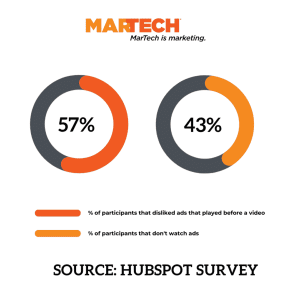

Shares of Snap, the parent company of Snapchat, tumbled to a new low Monday after the company was downgraded by another group of investment analysts—Wedbush’s this time. They cut shares from an “outperform” rating to a “neutral” rating, fixing a $36 target price on stocks and writing that “we see risks to Snap’s revenue growth targets stemming from IDFA headwinds, difficult comps from stellar growth in 2020-21, and increasing competition from TikTok in particular.”

“IDFA headwinds” refers to the tweaks that Apple made to privacy rules for mobile-app advertising back in April. An iPhone update gave users the power to stop advertisers from using a device ID. The move caused the social media giants to take a big wallop—reportedly a collective loss of $10 billion.

Since then, TikTok’s rise has remained meteoric, Facebook shares have rebounded, and Google barely even registered the hit as YouTube’s parent company. Yet the downward arc has continued for Snap: Shares took a major plunge in October, going from around $75 to $55, after the company posted not great third-quarter earnings. Last week, shares sunk below $40 for the first time since late 2020 after Cowen, another investment firm, cut its rating, citing research that showed ad buyers are still hesitant to spend their money on the platform. Add Wedbush’s new downgrade, and this morning Snap shares opened 5% lower, at $30.50.

For months, Snap has said it’s building new “tools” and “solutions” so advertisers can adapt to Apple’s privacy changes. It’s set to announce earnings on February 3, revealing how well it’s adjusted. Many other big tech companies are releasing earnings around the same time. (Microsoft, IBM, Intel, and Apple report theirs this week.) All of those numbers are coming into an environment on Wall Street where fears of runaway inflation and rate hikes are clobbering tech stocks just generally. Big Tech is actually seeing the worst start to a year since 2016, and meanwhile the Dow is down today by more than 730 points (or 2.2%), the S&P 500 fell 2.4%, and the Nasdaq Composite, which entered correction territory last Wednesday, lost 2.7% in morning trading.

(37)