The pandemic has rerouted McDonald’s business through exactly the channels you’d expect: toward the drive-thru lane and onto food-delivery apps like DoorDash and Uber Eats. To roll with it, McDonald’s has made adaptions on the fly, but the company hasn’t been able to stop profits from falling, life from becoming more hectic for stores, or the staffing shortages that followed COVID-19’s onset.

The company has tried to address these obstacles in various ways, including unveiling a plan to reduce drive-thru wait times by simplifying the menu. That’s an area where it’s lagged behind other fast-food chains, and executives say it has worked. However, little’s been said about efficiency on the delivery-app side, and it sounds as if things have also been bumpy over there. According to a new Wall Street Journal story, DoorDash feels that McDonald’s locations are filling delivery orders so slowly that deliverers’ wait time became a negotiation point in the partnership agreement that the two companies just signed a few months ago.

According to the report, starting next year McDonald’s locations where Dashers have to stand and wait will pay DoorDash a higher commission fee.

Other than that, though, it sounds like the deal between DoorDash and McDonald’s is actually pretty good one for McDonald’s: DoorDash agreed to lower the base commission rate, according to the report. Commissions vary by restaurant partner, and because of McDonald’s enormous size, it was able to leverage a low rate. Previously, it was 15.5% for all orders. The Journal says under the new terms, DoorDash has agreed to pocket an 11.6% starting commission on regular orders, and 14.1% on DashPass subscriber orders.

However, anytime DoorDash is forced to wait, those fees will now climb quickly. The increase reportedly begins at the four-minute mark, then tops out, at 17.6%, for non-DashPass orders where the delivery person waits more than seven minutes. For DashPass orders, that wait will saddle McDonald’s with a 20.1% fee.

A DoorDash spokesperson said the company doesn’t comment on contracts, but cautioned against assuming those rates apply to every McDonald’s location. “The fee structures for our merchant partnerships can vary by store or franchisee location and, in practice, can be determined by a variety of factors, including volume, average delivery distance, and value-added services, as well as operational performance and quality,” the company said. “Any summary figure is highly misleading. Our platform’s quality-based incentives help reduce Dasher wait times in order to maximize their earnings and boost customer retention and revenue for our merchant partners.”

For its part, McDonald’s doesn’t see tying higher rates to individual store performance as a bad thing. “Commission rates are just one component we consider when establishing these strategic agreements,” the company told Fast Company, “which often take into account unique and reciprocal business objectives and allow our partners to capitalize on the unmatched advantages that a global partnership with the largest restaurant company in the world provides.”

Mark Salebra, chair of the National Franchisee Leadership Alliance, seemed to back up that assertion. “The fact that these long term agreements are, at their core, designed to financially reward best in class service and operations is something that we all can be supportive and excited for,” he said in a statement.

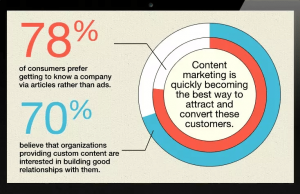

Still, these commission numbers, even if they vary by store, offer a rare look at the pandemic era’s negotiating tug-of-war between restaurants and third-party order platforms. COVID has translated to high revenues for delivery apps like DoorDash. But profits have still proven to be a challenge. The apps have been working to optimize their AI, so orders are assigned to delivery people who arrive precisely as the bag of food slides onto the counter. But this technology costs money, and customers now balk at the high delivery fees, confused when a $27 dinner balloons to $50 at checkout, after service fees, delivery fees, and the tax and tip.

Meanwhile, restaurant partners don’t like the high rates they’re charged either. Last year, DoorDash and Uber Eats responded to this pushback by creating a sliding scale for independent restaurants. Those businesses can chose to pay anywhere from a 15% to 30% commission; the apps will scale their marketing and other support up or down based on which percentage the restaurant chooses. Cities like New York, Chicago, and San Francisco have since stepped in and passed laws capping the max commission at 15%, to protect vulnerable smaller restaurants. But even in cities without commission caps, McDonald’s new base rate to DoorDash is quite favorable. (Though it’s unclear how the extra-high commissions at slower McDonald’s stores would operate in cities with 15% caps.)

All of this is why McDonald’s sees the DoorDash partnership as a victory that should “create a seamless experience for customers, crew, and couriers, and sets a strong foundation for future growth.” There’s one largely overlooked part of the new deals that McDonald’s negotiated with both DoorDash and Uber Eats, and that’s the integration of delivery into McDonald’s own smartphone app, meaning customers no longer have to open or even use DoorDash or Uber Eats’ app to complete their orders.

(30)