Change is sometimes necessary when it comes to payments. It can be a business’ Achilles’ heel to do things simply because “it’s always been done this way”. With new, emerging technology and changing consumer behavior, merchants will do well to exercise agility and ability to adapt. The following five traditional payment practices may be hindering your growth.

1. Only accepting cheque and cash

Whether you’re a new local boutique or an established global wholesaler, if you still only accept cash and cheque, you could be losing out on sales.

The preference of more and more B2B and B2C customers is to pay with credit and debit cards so the ability to accept credit cards can help you better cater to your clients. Both businesses and consumers may prefer to use credit cards for added benefits like travel points, rewards, cash back, etc., and they’ll appreciate the luxury to be able to choose their preferred payment method.

Beyond accepting credit and debit cards, you may want to think about expanding your payment options to other forms of electronic payments like mobile wallets or cryptocurrencies if it makes sense for your business.

2. Invoicing the traditional way

Traditional paper invoicing is time-consuming and tedious for many businesses. With paper invoicing, there are manual account reconciliations, lost cheques, late payments, bad cash flow, and arduous filing.

Switching to digital invoicing allows you to streamline your payment processing and administrative duties. You can send invoices electronically to your customers who then pay in just a few clicks. Also, you can set up automatic reminders to avoid late payments, preventing stagnant cash flow.

A cloud-based invoicing platform makes storing transaction records and client payment information convenient and secure – you can access your transaction data anywhere, anytime, minimizing the risk of misplacing invoices and your scope for PCI compliance.

3. Having a clunky checkout process

In the age of ubiquitous connections and instant gratification, customers expect fast, personal experiences throughout the customer journey regardless of channel. These days, the more friction there is during the path to checkout, the higher the chance that customers will abandon. Whether your business is online or in-store, you have to increase ease of checkout.

Online transactions

One way to speed up your online checkout process is through recurring billing; it increases your efficiency, streamlines your day-to-day transactions, and saves your customers from providing their credit card details every time.

A fast checkout process means only asking for essential information. By rearranging the order of the fields, you can automatically determine certain information, reducing the number of checkout fields required.

- Put the zip/area code field first to automatically populate the city, state, and country fields.

- Set the most inexpensive shipping method as default.

- Use an algorithm to automatically detect the credit card type by the first few digits.

In-store

The number of consumers paying with mobile wallets or EMV cards via tap-and-pay is increasing. Contactless payments are fast, secure, and convenient; consumers simply tap their phone or chip and PIN card to complete their transaction. If you haven’t already upgraded your terminal to an NFC-enabled one, it will speed up checkout times significantly, keeping lineups moving quickly.

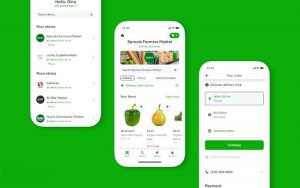

Another option to consider is accepting payments with a mobile app and/or card reader. This allows you to accept payments anywhere in the store and provide secondary support when the main checkout lines get too long.

Offering a wide range of payment methods will also speed up your checkout process by allowing customers to pay with their preferred payment method.

4. Operating in silos

These days, consumers expect an omnichannel experience: unity and consistency in every interaction with a brand.

Everything from inventory to customer service has to be consistent across all channels to ensure the same experience throughout the shopping journey; 73% of consumers are likely to switch brands if a company provides inconsistent levels of service across departments. The follow are some tips on how to unify your customer experience:

- Allow customers to return items purchased online to a physical location

- Optimize the website for mobile devices

- Sync online and offline inventory and CRM systems to ensure accurate, consistent information

- Offer 24/7 customer service across so people can reach you when they need assistance

5. Not utilizing payments data

Customers now interact with brands in many ways (email, social, in person) so then the challenge becomes reaching the right customer at the right time. Consumers want more personalization in their shopping experiences and are willing to give their personal information to get it, which means you have the contact information to deliver your message or offer for an optimal impact.

When you have their contact information, payments data will help dictates what your message will be. Your transaction data can reveal your customers’ behavior, needs, and wants. Looking at past customer behavior (popular purchases, frequency, and order amount) can help you personalize the shopping experience. Try emailing product recommendations and related items or launching retargeting ad campaigns. Payments data helps you make informed decisions, assess goals, and better sell to your customers.

Every business is different. Assess your needs, bandwidth, and budget to determine if it’s worth moving on from these traditional payment processes and grow your business by catering to evolving consumer preferences and behaviors.

Business & Finance Articles on Business 2 Community(96)