U.S. CTV Ad Spend Exceeds $1B-Per-Month Milestone

U.S. ad spend in connected TV reached a new high of $1 billion per month in June among platforms tracked by Vivvix.

The data includes ad dollars spent by thousands of advertisers across two leading free, ad-supported streamers (FASTs), Pluto TV and Tubi, and seven of the largest platforms with ad-supported video-on demand (AVOD) tiers (Hulu, Peacock, Paramount+, Discovery+, Max/formerly HBO Max and Roku).

It must be pointed out that that total is an underestimate. It doesn’t include one of the largest FASTs, The Roku Channel, or Amazon’s Freevee, Xumo Play or the many other FASTs out there, or Netflix’s ad-supported tier launched last November, or YouTube TV or other YouTube platforms. (Vivvix does track YouTube separately, and reports that its properties captured a combined $1.4 billion in June.)

Still, the $1 billion milestone is attention-getting, and “validates the projections on CTV’s ascendency from experimental to a ‘table stakes’ medium,” said Andrew Feigenson, CEO of Vivvix, an independently operating Kantar Group company formed this year by the merger of the Kantar and Numerator advertising intelligence businesses. “It’s where viewers are increasingly spending their time, and to be competitive, brands must play ball on those fields.”

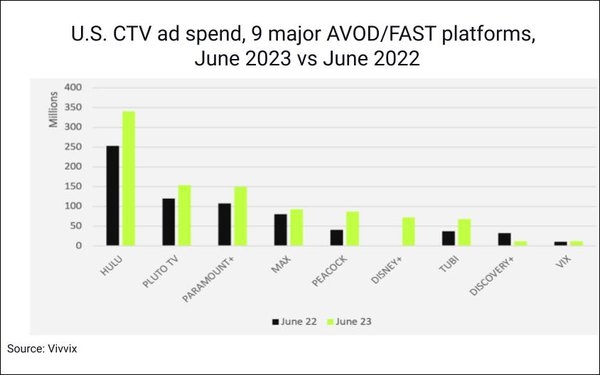

Across the platforms tracked (excluding Disney+, which just launched its ad-supported tier in May), ad spend in June grew 37.8% year-over-year.

Hulu continues to command by far the largest share of spend among the platforms tracked, with nearly $350 million in June — up from $250 million in June 2022 (chart above).

Pluto TV holds the No. 2 position, slightly edging out Paramount+ (both pulled in nearly $150 million in June). Pluto is far ahead of rival FAST Tubi, which pulled more than $50 million for the month.

Peacock — which eliminated its free, ad-supported tier for new subscribers, in favor of an AVOD tier, as of February this year — showed the highest YOY ad-spend growth in June, at 113%, although Max pulled in slightly more ad dollars.

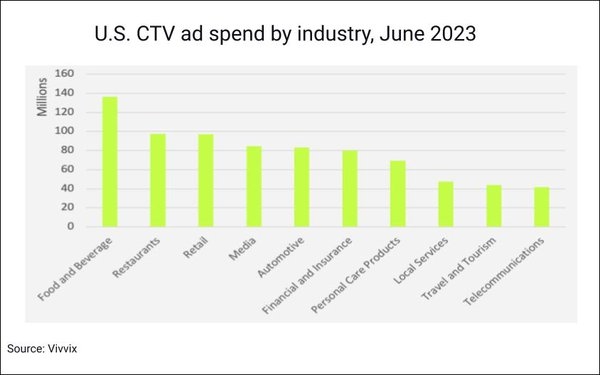

The top CTV spender by industry/category by a wide margin was food and beverage, at about $136 million in June (beverage spend alone rose by 300% YoY), followed by restaurants and retail, each coming in at just below $100 million.

Financial/insurance was the top investor in both Pluto ($18.3 million, or 22% of the platform’s total ad revenue) and a big investor in Disney+ ($9.6 million). The games/toys/sporting goods category also spent big in Pluto ($9.5 million).

Beyond the top 10, household supplies showed 300% YoY growth. Slower-growth categories included pets and cosmetics/beauty.

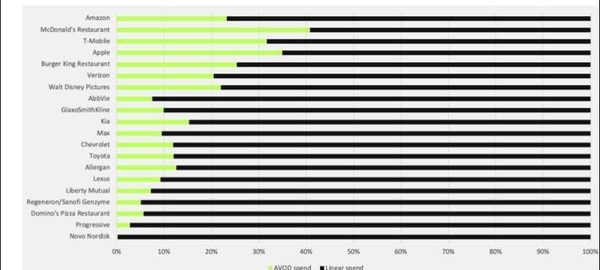

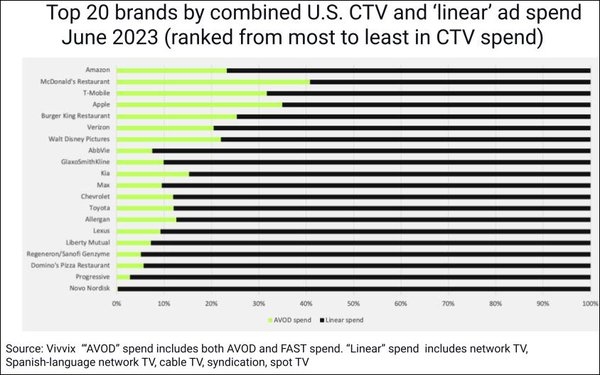

Here are the top 20 brands with the highest combined streaming and what Vivvix calls “linear” spend (defined as including network TV, Spanish-language network TV, spot TV, cable TV and syndication) in June, ranked by those spending the most to least dollars on CTV in June.

Amazon didn’t have the largest percentage share of spend in CTV (about 25% of its TV budget, compared to McDonald’s’ allocating 40%-plus of its TV budget to CTV). But Amazon did spend the most dollars on CTV among these 20 brands during June — and was also the third-largest CTV spender among all brands tracked, according to Vivvix.

In fact, Amazon upped its CTV dollar investment by 100% between May and June, the researcher reports. Meanwhile, Progressive upped its CTV spend by 577% versus May, and T-Mobile upped its CTV spend to 31%, from 21%. The only big brand to decrease its CTV share investment in the period was Verizon — down to 20.4%, from 22% in May.

The month’s first and second-largest CTV spenders by dollars were Land Rover and Credit Karma.

Both of them (along with No. 3 spender Amazon) dedicated more than 40% of their streaming budgets to Pluto TV (Land Rover 45%, and Credit Karma more than 55%).

Target allocated 50% of its CTV spend to Hulu, while Amazon allocated under 10% to that streamer.

Vivvix’s first-half report on streaming platforms estimated that CTV ad spend increased 79% year-over-year in 2022, and totaled 5% of all online video spend.

(4)