The best businesses know how to adapt. The dominance you’ve enjoyed could be undermined by a startup that sprang up virtually overnight. So how do you stay ahead? By benchmarking.

Benchmarking is a matter of using data to compare yourself against competitors or your own past performance. Entrepreneurs benchmark to improve internal processes, track campaign effectiveness, and strategize growth.

To start benchmarking, ask yourself three questions to know how and why to do it:

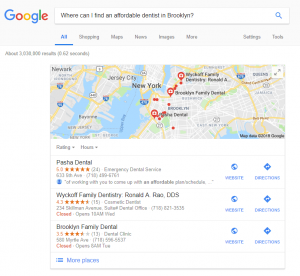

- Who are your competitors?

Do you do business only in Missouri? Don’t worry about what California companies are doing. Select direct competitors that are performing at the same level or higher than you. They’re the ones you need to beat and whose success is worth learning from. - What are your goals?

Success means different things to different companies. Are you trying to scale your one store to 10? Are you trying to double your annual revenue? Be specific about what you want to do so you can choose relevant standards for your business. - What data do you need?

After you’ve determined your goals, start collecting data. If you’re trying to build a top-notch marketing funnel, for example, charts on employee work hours won’t be as useful as data on your quarterly sales figures or your competitors’ site traffic.

Benchmarking Your Way to Success

Because there are so many factors and kinds of data to consider when benchmarking, here are four places to start:

1. Revenue Growth

Revenue is one of the foundational indicators of business success. The more money a business brings in, the more valuable it becomes in the eyes of customers, partners, and shareholders. Even if your company is doing the best it’s ever done, it’s essential to know how it compares to others in your market.

Cash-flow technology company Kabbage publishes a Kabbage Small Business Revenue Index that lets you track your growth against similar companies in your space around your size. Built with data drawing from more than 200,000 U.S. small businesses, the Index shows how your revenue numbers stack up across the country, by state, and by industry. Although you should expect month-by-month fluctuations, your goal should be to remain at or ahead of the revenue curve.

2. Resource Allocation

What if you’re making money but still feel like you’re falling behind? Revenue is a measure of money coming in, but you also need to take inventory of money going out. Unfortunately, expenses are tougher to generalize about than revenue.

Start by looking at labor expenses, which make up as much as 80% of small business expenses. How many people do you employ compared to companies in your space around your size? Check sites like Glassdoor to get a sense of whether your salaries and benefits are in line with those firms.

Next, look at your overhead expenses. How big is your office? Does office space in your area rent for a similar rate as your competitors’? How do your supply costs compare to those sourced through group purchasing organizations?

3. Customer Experience

Customers aren’t just a source of income. They’re also a key source of feedback about your processes, services, products, and marketing.

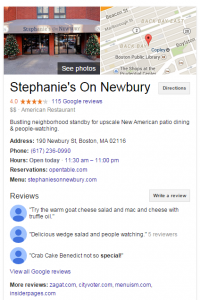

Something like your customer experience can’t be quantified, but you can still benchmark it. Compare your online reviews to your competitors’. Don’t take a single review as gospel. Instead, look at trends. Maybe Company A consistently gets praise for its product quality, while Company B struggles to field customer questions. Note patterns in your and your competitors’ perceived strengths and weaknesses.

Although Google and Yelp are obvious places to start, use social listening tools to capture feedback that isn’t posted on review sites. In this case, you can use hard numbers: If you received two compliments on your customer service one month, five the next, and 10 the month after that, you can bet your training initiative is paying off.

4. Employee Turnover

Employee turnover is the canary in the coal mine: If your processes, culture, or value proposition are weak, one of the first signs of trouble is above-average turnover for your industry.

Again, don’t assume that one employee leaving means your company is failing. People move, spouses get jobs elsewhere, and career goals change. But if your annual turnover exceeds LinkedIn’s industry averages, take a good look under the hood.

Exit interviews are an excellent opportunity to discover what’s going on. Because employees who are headed out the door have no incentive to paper over problems, feel free to ask hard questions. Is the culture oppressive? Are client expectations all over the map? It doesn’t feel good to hear your company criticized, but hard conversations are how you get to the root of the issue — and preempt future criticisms.

Although you can benchmark almost any metric or area of your company, begin with the four that matter most: your income, your expenses, your customers, and your team. If any one of those isn’t up to snuff, you need to know it.

Business & Finance Articles on Business 2 Community

(38)