Why FinTech companies need a scalable referral marketing program

It’s no secret that business in general is changing fast for the financial industry and FinTech (financial technology) is no exception. While FinTech companies (like Lending Club, CommonBond and Kabbage) originally focused on stealing small and medium sized businesses (SMB) away from big bank lending, the amount of underwriting big banks require for each loan does not give SMB loans the appealing return on equity (ROE) it once did. Therefore, it’s no surprise that many have decided to step back from smaller SMB loans.

So what does this mean?

It means that while FinTech lenders are out running some of the traditional financial institutions they now need a newer and better way to disrupt the alternative lending world. That’s right. They need to disrupt the disruptor.

After all, even though some of the competition is being reduced in the big bank world, it doesn’t mean that the large number of FinTech lenders have stopped growing or getting any less determined.

But how do you disrupt the disruptors?

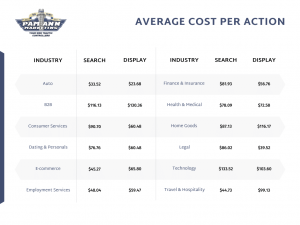

FinTech lenders need a highly charged customer acquisition channel. But even though many of the big banks may not be FinTech lenders’ biggest competition any more they have had years to establish SEO keywords and PPC. Which means that it will be very hard if not nearly impossible to surpass them in organic search or PPC. In fact many of the traditional channels have such a high volume of traffic already and have been mined so thoroughly that it is very difficult to make a real mark with them.

Instead, when trying to create a powerful channel for customer acquisition focus on 3 keys in order to break through the noise of your competitors.

- Establish a proprietary channel

- Ensure your channel is data-rich

- Confirm that your channel integrates with your current technology

One such channel that covers these 3 bases and empowers customer acquisitions is referral marketing. Automated referral marketing software gives FinTech lenders the ability to optimize customer acquisition along with taking on other challenges in addition to finding new lenders and borrowers. This includes conquering 2 main obstacles that face FinTech lenders.

- Become more efficient through automation, to scale the business and increase revenue

- Delivering a superior customer experience

Automated referral marketing programs do this by incentivizing Advocates to make a trusted introduction to their peers and have therefore been proven to:

- Convert leads 4X better than traditional marketing (emarketer)

- Decrease churn by 18% compared to non-referred customers (Harvard Business Review)

- Increase LTV by 16% compared to non-referred customers (Harvard Business Review)

- Have a conversion rate of 36% from referral to new customer for a financial service company (Amplifinity Financial Service case study)

And for FinTech lenders, there is more than one way to take advantage of referral marketing programs. Along with the traditional customer referral marketing program, a partner referral marketing program can prove to be very advantageous for FinTech lenders. Since as previously stated, many big banks no longer find it worthwhile to pursue SMB loans and small personal loans, they are primed to become a partner. A scalable automated partner referral marketing program enables FinTech lenders to take advantage and leverage financial institutions to refer lenders and borrowers that don’t meet their qualification but would fit securely into a FinTech marketplace lender’s preferred demographic.

But what would motivate bigger financial institutions to refer? Bigger banks and finance companies have long been trying to improve customer engagement and experience. Referring leads to a FinTech lender would appeal to a financial institutions since it would provide them with a way to give customers and prospects a more full service offering that improves their image and meets a wider group of customer and prospect needs. In addition, FinTech marketplace lenders can provide referrals back to partners and offer an incentive if a bank or financial institution’s referral becomes new business.

Business & Finance Articles on Business 2 Community

(114)