There are many milestones to reach as an adult, from the first legal night at the bar, to the first car purchase, to the first “real” job. One of the most important “adult” milestones to build a foundation for a financially secure future, is to achieve a great credit score, but for millions of Americans, this seems like a goal that is forever out of reach.

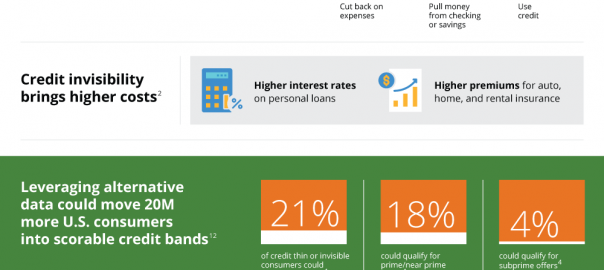

Currently, one out of every five Americans does not have enough credit history to even acquire a credit report. It would be one thing if we could just start from the ground up, but so often, the credit system gets us caught in a never ending loop in which we cannot start building credit because we don’t already have credit. It’s evident that this cycle doesn’t make much sense and needs to change.

Those who are most likely to get caught in this “no credit history” cycle are those who are young or new to credit, Hispanic or African American, recent immigrants, recently divorced or widowed, and those who use mainly debit cards or cash, to name a few. Although millions are considered “credit invisible”, this doesn’t equal financial irresponsibility.

The fact is that many “credit invisible” individuals are financially responsible in paying their bills and saving their money. Statistically, nearly half of these individuals would be considered prime or near prime borrowers if credit reports included alternative data.

Alternative data, such as rental payments, utilities payments, phone payments, and banking transaction history, could mean that 90% of unscorable individuals could finally be scored with accuracy based on real data, rather than simply relying on only data that exists for those already in the credit cycle.

Using alternative data to give an accurate credit score could significantly impact the finances of these millions of Americans. They could get better interest rates, use more reputable financial services in emergencies, and take advantage of all the perks afforded to those with good credit; thereby ensuring a more stable financial future and benefiting the entire US economy.

![Fixing the Credit Score Problem [Infographic] Fixing the Credit Score Problem [Infographic]](https://www.onlinesalesguidetip.com/wp-content/uploads/2022/01/Fixing-the-Credit-Score-Problem-Infographic.png)

Infographic Source: Equifax

Digital & Social Articles on Business 2 Community

(27)