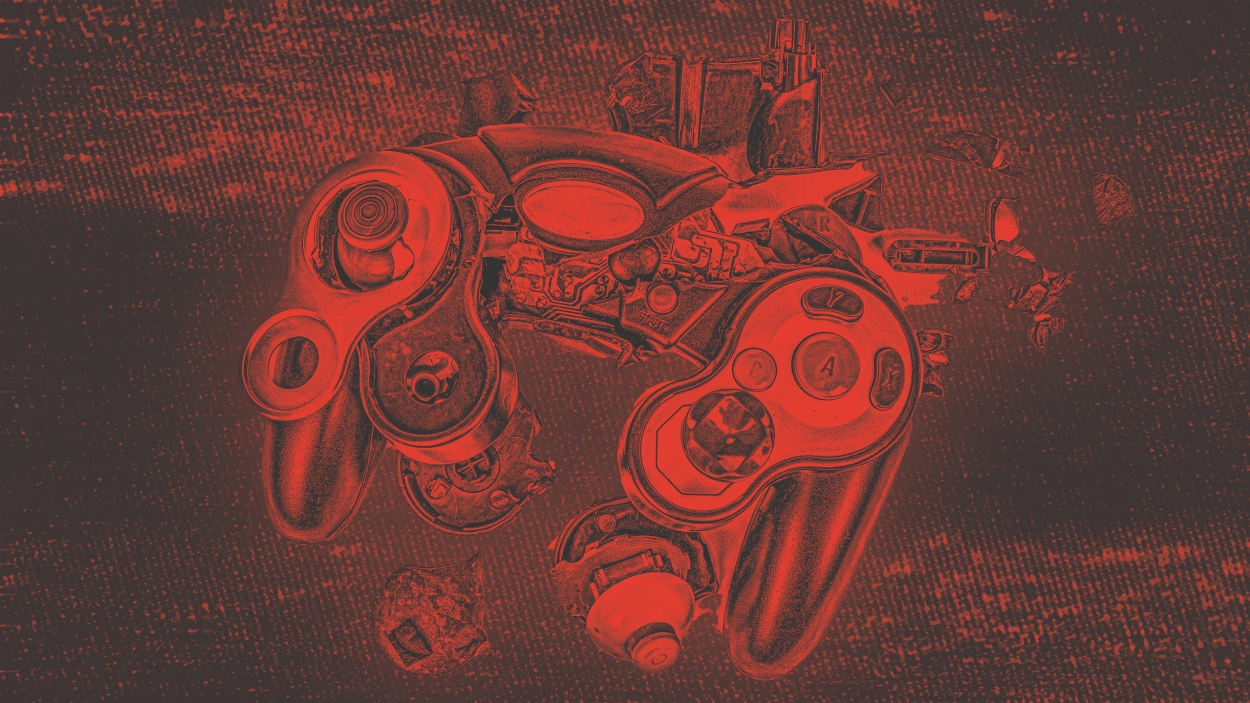

Wall Street, it would appear, has more than a few doubts about e-sports.

FaZe Clan, the digital gaming-and-e-sports-content platform that went public just over six months ago with a valuation of $1 billion, is already trading well below a dollar per share, putting the company at risk of delisting by the Nasdaq exchange.

Face Holdings, the parent company of FaZe Clan, has seen its stock price fall from a high of $24.69 on August 30, 2022 to just 75 cents on Thursday. Under Nasdaq rules, any company that fails to close above the $1 mark for 30 consecutive days is issued a deficiency notice, which can trigger a delisting.

It’s not an immediate action. Once the notice is issued, the company has 180 calendar days to return to compliance, meaning it must close above $1 for 10 consecutive days—and some companies receive a grace period of another 180 days if they meet special requirements.

Still, a fall this sharp in such a short period is certainly cause for alarm.

FaZe announced plans to go public via a SPAC (special purpose acquisition company) deal in October 2021. At the time, the company said, “We have a tremendous opportunity ahead of us. FaZe is evolving from a digital publisher into an intellectual property engine, which we believe will unlock new ways to diversify our revenue.”

Shares began trading on July 20, and things went well for the first two months. In late September, however, the price began to fall—fast. Investors, reading between the lines of an amended registration filing with the Securities and Exchange Commission (SEC), feared that a wave of insider selling was about to hit as lockup periods expired.

Insider selling is one of the big dangers of SPACs. And there has been “significant” insider selling over the past three months, notes Simply Wall Street. Additionally, the market capitalization of the company is low (roughly $65 million), which is another area of concern for investors, as small cap stocks tend to be more volatile.

FaZe’s listing on the exchange was always a bet of sorts. It was among the first companies born from the creator economy to go public, but it did so at a time when most tech companies were pumping the brakes on public offerings. IPO deal proceeds, on the whole, plunged 94% in 2022, according to Ernst & Young’s IPO report, with “lows not seen since the peak of the great recession.”

FaZe Clan, whose investors include NBA stars Ben Simmons and Jamal Murray and musicians Offset and Pitbull, started in 2010 as a group of friends playing Call of Duty. It has grown into an e-sports and entertainment powerhouse, with a content production studio, a talent management division, a direct-to-consumer e-commerce business; and a sales team negotiating brand deals with companies like McDonald’s, DC Comics and Xbox.

The company boasts a social media following of more than 500 million and a roster of more than 100 influencers and 12 e-sports teams.

It’s worth noting that a delisting notice, should it come, isn’t necessarily fatal. Several brands have bounced back from the low, including Delta Air Lines, which was delisted in 2005 and Six Flags, which was delisted in 2009.

FaZe Holdings did not promptly reply to Fast Company’s request for comment about the possibility of a delisting or how it planned to boost its stock price.

(22)