Amazon Prime Day Ad Messages Muddled On Economic Challenges

Amazon Prime Day sellers have a challenge based on the economy. The company supports more than 200 million paid Prime members globally.

Messages are mixed and muddled this year on economic forecasts. Third-party data and research companies have varying views on how consumers will spend money this year.

McKinsey & Associates released data in June that suggests “optimism is trending upward, but spending isn’t.”

The report from McKinsey states that the decline in overall real spending growth accelerated in April 2023 — but for the first time since the pandemic, the change in real year-over-year spending entered negative territory across all age and income groups.

The rate of decline was relatively consistent across demographic groups, but was steepest at 4.5%, among low-income consumers.

It appears that Amazon Prime Day may have a different effect and influence on consumers.

Thirty-party marketing firm research from Jungle Scout forecasts roughly 68% of Amazon Prime members will shop during the ecommerce sales event, despite an uncertain economy.

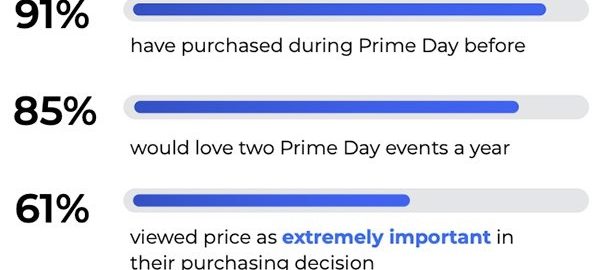

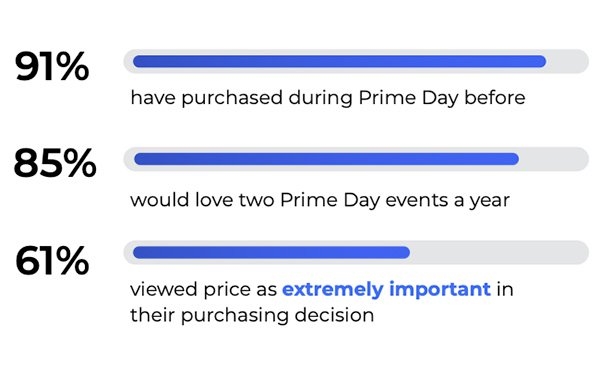

Amazon Prime Day 2023 is set to take place on July 11 and July 12, directly after the long U.S. holiday. Omnichannel marketing platform, Skai, recently performed a 1,000-person Amazon-focused poll that highlights customer attitudes around Prime Day and Amazon promotions.

Given the state of the economy, only 14.3% in Skai’s survey said they plan to spend less this year, while 27% plan to spend more.

Some 95% of respondents said they will likely browse or buy something during Prime Day this year, and nearly 70% are likely to compare prices on other retailers’ websites before making a purchase on Prime Day.

Consumer electronics, household products, and fashion and apparel are the top three categories that consumers are most interested in shopping for this Prime Day.

The data also shows that 91.3% of consumers are interested in buying consumer electronics on Prime Day, 93.9% are interested in buying household products, 89.2% are interested in buying fashion and apparel, and 83.1% are interested in buying beauty and personal care products.

Consumers are also looking to buy for pets. In fact, 74.3% said they would likely buy pet products, and 74.1% would likely buy toys and games.

Top ecommerce retailers have held competing sales in previous years — but this year, stores like Best Buy are doing more. Best Buy’s sale is open to all consumers, but certain deals are limited to rewards members.

Target will hold its sale from July 9 through 15, with sale prices as much as 50% off on the retailer’s white-label brands, along with discounts on national brands like Dyson and Keurig.

Walmart’s first 24-hour sale on July 10 will only be available to Walmart+ customers.

(2)