In the first post of this two-part series, I addressed a key question that often surfaces about who owns the renewal. In this post, I’ll address the most frequent question I’m asked by customer success leaders—what is the best compensation plan for Customer Success Managers (CSMs)?

Compensation Plans for Customer Success Managers (CSMs)

There’s wide debate in the customer success discipline regarding the best structure for a CSM compensation plan. Typically, I see the following three CSM compensation models:

- Base Only – pure base salary with no bonus or variable component

- Base + Bonus – base salary with a small bonus structure, usually in the form of a Management by Objective (MBO) bonus

- Base + Variable – base salary with a variable component to not only reward for performance, but also to provide more upside for over-achievement against targets.

I’ve tried all three models over the years and prefer the third model: Base + Variable.

Before I explain the benefits of a variable compensation plan, let me discuss the deficiencies of the first two models.

Three CSM Compensation Models

1. Base Only

In my opinion, a CSM compensation plan that is 100% base salary is a mistake. Base only compensation plans do little to align CSMs to company objectives and also provide no additional incentives (other than personal pride and work ethic) to achieve or overachieve the expected performance standards. CSMs are neither impacted by severe under-performance, nor rewarded for over-performance. A base only plan typically leads to mere status quo across the team.

How to Transition Comp Plans

If your CSMs are currently on a 100% Base Only compensation plan and you’d like to switch to another model, what’s the best way to migrate your current CSM team to another comp plan with the least disruption?

For new employees, it’s easy. Just start them on the new plan. But for current employees, you need to migrate with care and consideration. Some may consider just ripping the bandaid off, lowering their base, and implementing a bonus or variable plan. Doing so will be a hard pill to swallow for the CSMs as they are used to (and rely on) their current base salary.

Instead, consider adding a bonus or variable comp on top of the base salary (if you have the budget to do so) or using annual pay increases as a way to slowly migrate in the direction you’d like. Instead of increasing the base salary, put all the increases into a bonus or variable plan for the CSM. While this tends to be a viable option, it will typically take time for the annual pay increase cycle to complete the transition.

2. Base + Bonus

The Base + Bonus option is a great step in the right direction. As stated above, usually the bonus is in the form of an MBO plan in which the CSMs are measured against a handful of key objectives – individually and/or as a team. Ideally, most objectives are quantitative and aligned to the important KPIs of the business (retention, upsell, cross-sell, NPS, # of case studies, etc.). However, many times MBOs also have one or more qualitative objectives as well, such as contribution to the team, leading a special project, etc.

Adding the bonus structure is a step in the right direction as it aligns performance to company objectives and rewards accordingly. However, from my experience, a bonus structure still has a few shortcomings.

Shortcomings of Base + Bonus Model

Let me highlight one challenge by sharing an example.

At Omniture, one of our Strategic CSMs in EMEA was assigned to a strategic account that was a Global Fortune 100 company. The CSM worked tirelessly the entire year to successfully manage this customer and drive value across their global entities. For most of the year, the CSMs counterpart on the sales side of our business was nowhere to be seen, only occasionally popping into the equation to see how things were going.

At the end of the year, the strategic customer signed a multi-year, multi-million dollar renewal that significantly changed the trajectory of our relationship with that customer, largely due to the tremendous work of the CSM. At the time, we were compensating our CSMs on a mere bonus structure and this CSM probably made $ 2,000 on the renewal. You can imagine the frustration of the CSM who came to me and said, “Why is it that I did all the work throughout the entire year to ensure this strategic account renewed (and they renewed in a big way), and yet I get a $ 2,000 bonus and the sales rep (who did nothing all year) bought a new yacht with his commissions?” And he was right. That is when I became converted to at Base + Variable plan.

3. Base + Variable

I’m a fan of a Base + Variable compensation plan because I believe it provides the best alignment with the core objectives of the CSM team, drives clear accountability for performance (or lack thereof), and generously rewards CSMs for achieving or over-achieving their targets.

Variable on Retention and Growth

I’m a big believer on keeping things simple so I recommend focusing the CSM comp plan on their two main objectives: retention and growth (expansion). You may have other key performance objectives you’d like your team to execute against (NPS, adoption goals, DELTs, quarterly team projects, etc.) and that’s just fine. But I would track those separately and focus the compensation plan on 2-3 KPIs, in this case, retention and growth.

Building Out Your Variable Compensation Model

Since Base + Variable is my favorite compensation model for CSMs. Here is a little more details on how to approach setting it up. My first advice when building a variable compensation plan for CSMs is to keep things as simple as possible and focus on 2 or 3 (max) KPIs. With that in mind, let’s break down the key elements to consider when designing a variable compensation plan for your CSMs.

4 Key Variable Compensation Elements

1. On-Target Earnings (OTE) Split

First, determine the ideal base-to-variable compensation split for your CSMs. This will designate the portion of the on-target earnings (OTE) that will be allocated to base salary vs. variable compensation.

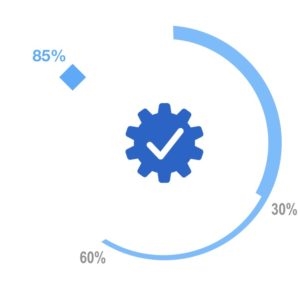

I like to see the base-to-variable split anywhere from 70/30 to 80/20 against the total on-target earnings (OTE). If the variable comp is greater than 30%, it starts looking like a sales compensation plan; however, if the variable is lower than 20%, the variable portion isn’t large enough to drive the added motivation and starts looking like a simple bonus plan.

A good compromise is a 75/25 base-to-variable split. In that case, CSM with an OTE would have 75% ($ 75,000) allocated to base, and 25% ($ 25,000) allocated to variable compensation.

2. KPI’s for a Variable CSM Comp Plan

Next, identify the KPIs that will be the basis of your plan. In the spirit of keeping things simple, I prefer to focus on the two main objectives of a CSM: core retention and expansion (growth). For both KPIs, I’d focus on revenue – core revenue retention (excluding cross-sell & upsell) and revenue expansion (up-sell and cross-sell).

Some will disagree with measuring CSMs on retention and growth, preferring to measure them on customer satisfaction or other objectives (NPS, adoption goals, DELTs, quarterly projects, etc.).

However, ultimately your business is expecting your CSMs to retain and expand your customer revenue so don’t beat around the bush and just measure them against those metrics. They are aligned to core business KPIs and aren’t “squishy” as Jason Lemkin would say.

3. Variable Split

Now that you have your 2 KPI’s identified, you need to determine how much of the variable portion will be paid against each KPI. I suggest you mirror the OTE split ratio (keep it simple) and use the same percentage split for retention vs expansion. Focus the majority of the variable on retention to reinforce the fact the CSM’s primary responsibility is retention.

Variable Split Example

Referring back to our example above, with a 75/25 OTE split you will then mirror that with a 75/25 retention-to-expansion split for the variable portion of the comp plan.

OTE Variable Split to Achieve OTE

OTE = $ 100,000

OTE Split = 75%/25% base-to-variable

Base = $ 75,000

Variable = $ 25,000

OTE Variable Comp with % Weight

Variable Split = 75%/25% retention-to-expansion

Retention = ($ 25,000 * 75%) = $ 18,750

Expansion = ($ 25,000 * 25%) = $ 6,250

4. Variable Targets, Payouts & Accelerators

Now the final component of the variable comp plan is setting the targets, payouts and accelerators for the team. (Note, I prefer to use the word “target” and “payouts” vs. “quota” and “commissions” to distance – or differentiate – this plan from a sales plan.)

For each KPI, determine the target retention number and expansion number you want the CSMs to hit in order to receive 100% of their payout for each period (month, quarter, or year). It’s important to work with your CFO to ensure that the combine targets for the team are completely aligned to the targets for the company, otherwise the misalignment can be costly.

Once the target has been set for 100% payout, then determine the sliding scale for under performance as well as over-achievement. I prefer to give CSMs accelerators to reward over-achievement and monetary upside for extraordinary results.

Here is an example of a sliding scale for each KPI.

Revenue Retention Target = 90%

Revenue Expansion Target = $ 50,000

One way to simplify the expansion variable compensation payout is to just pay a small percentage of all expansion dollars which will naturally reward higher for over-achievement. If you go with that option, you may consider whether to cap the upside or leave it uncapped.

Percentage of Expansion Revenue Variable Compensation Model

This model has the following advantages:

- Incentivizes the CSMs with a small variable compensation plan while still keeping them clearly differentiated from a more leveraged sales compensation model which is typically closer to 50/50 or 60/40.

- Focuses the CSMs on their primary responsibility of retention while rewarding their efforts that result in growth (expansion, upsell, cross-sell).

- Rewards the CSMs with upside as they exceed their retention and growth targets.

- Aligns sales and customer success to ensure they are collaborating effectively to drive retention and growth across their shared book of business.

On this last point, I’d consider a reverse comp model for sales with their variable comp focused 75% on new business growth and 25% on retention. This ensures the primary responsibilities of sales and customer success are reflected in their respective comp plans and aligns them in a complementary way to drive growth and retention.

I hope this helps guide you as you build out your customer success compensation plans.

Check out our resources below for more customer success best practices and insights for how your organization can approach customer success with the customer at the center:

eBook: 5 Ways to Surprise & Delight Your Customers

Business & Finance Articles on Business 2 Community(361)