“Dis-ruhp-shuh n”―a radical change in an industry, business strategy, etc., especially involving the introduction of a new product or service…disrupting innovation.

We are swimming in marketing disruption. Data and technology are fundamentally changing the way brands market and interact with consumers. It’s almost a full-time job keeping up with all the changes.

What’s less well appreciated is that the same forces disrupting marketing are also disrupting new product innovation. New disrupting innovation tools will profoundly change the way companies discover, develop, and deploy new products. Disruptive new products disrupting new product development―a kind of “meta-disruption” if you will.

The Fundamentals of Innovation…Unchanging

Stepping back, the fundamental truths of what is required for new product innovation haven’t changed in decades and probably won’t ever change. Companies still need to:

- Discover a compelling proposition. Identifying white space opportunities, generating and maximizing ideas, and finally, measuring and improving them is the starting point for Innovation, but it’s really, really hard. How hard? Only 25% of concepts tested by Nielsen show high likelihood of in-market success, primarily due to weak scores on consumer need and desire.

- Develop a winning execution. Developing a product that delivers the proposition promise along with stand-out packaging and marketing communications that effectively translate the proposition into compelling marketing content is just as important as having a compelling idea. Among those product concepts Nielsen testing showed “ready” to move toward market launch, only 50% remained ready after consumers actually used the product.

- Deploy with excellence in market. Ultimately, deployment excellence is the only thing that matters. Executing a strong marketing plan, tracking results, and optimizing on-the-fly are critical for success. Nielsen data shows that over 25% of new products that test strongly at both concept and product still fail because of weak in market execution.

The Mandate for Change

The fundamentals of discover, develop, and deploy are immutable and unchanging. But something needs to give. In a recent Nielsen client survey, 75% of respondents say they’re using outdated technology in their innovation process. More importantly, 85% of FMCG (fast-moving consumer goods) new product launches are unsuccessful. If ever there was an opportunity for disruption, disrupting innovation is the space.

While the requirement to discover, develop, and deploy will never change, what is changing is the role of disruptive technologies in the innovation process―that is “how” innovation gets done. Specifically, large data sets, digital platforms, adaptive targeting, and e-commerce are enabling dramatic new approaches to the 3D’s of innovation. And, these disrupting innovation forces, if harnessed, should lead to much higher success rates for those companies that take advantage of them.

Discovery…Disrupted

Large data sets offer immense opportunity for discovery. Companies are mining large scale unstructured and structured data to identify previously unseen innovation insights and opportunities. For example, text analytics applied to unstructured data like online consumer reviews, patent filings, CRM customer feedback, etc., can uncover trends, white space opportunities, and new product ideas.

New digital platforms enable much faster discovery. They automate research that was previously manual and labor intensive. For example, concept testing cycle times are melting from weeks to days, enabling companies to significantly reduce total initiative time to market by a month or more.

Digital platforms also enable iteration at scale. The counter-intuitive idea that quantity begets quality―e.g., the more ideas you create, the more winning new ideas you find―is now reality. “Evolutionary” algorithms enabled by digital platforms iteratively sort through ideas to find the strongest and most appealing ones. Companies quickly and efficiently test literally thousands or hundreds of thousands of ideas to find the best ones―ideas that generate +35% more volume potential, on average.

Finally, digital platforms enable collaboration―key to innovation success―at scale. Nielsen research shows that six-plus member teams generate concepts which, on average, significantly outperform teams with two or fewer people. Yet, the majority of concepts are created by two or fewer people. Collaboration at scale can be internal or external. Global teams of employees collaboratively build new concepts, of course. But they can also leverage the wisdom of the crowd, using digital platforms to source new product ideas from external third party players. More ideas, better ideas.

Development…Disrupted

Large data sets help companies design better products, line-ups and formats. Sophisticated text analytic tools help companies understand the relative impact of different product features on online consumer ratings and satisfaction. Mining online unstructured data also enables companies to spot important product trends or identify consumer “wish for” features and formats not always voiced in standard survey research.

Companies are discovering that e-commerce is more than a distribution channel. It’s also an innovation platform. Most major brands develop their new ideas with little thought to the e-commerce environment. Yet, digital platforms are enabling concept and product testing in an e-commerce environment. And not just new product ideas, but also alternative line-ups, pricing and packaging. Further, e-commerce site shopping optimization and iterative A/B pair testing will become the norm.

Deployment…Disrupted

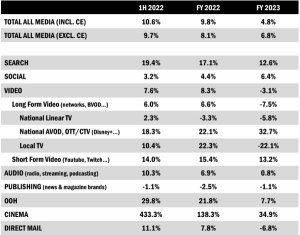

Companies are learning how to deploy their new product innovations via “adaptive targeting.” That is, they will identify the consumers who have the highest purchase intent and volume potential for the new item and then focus more of their marketing against these types of consumers. They’ll know where these high potential consumers live, shop, and what media they consume. Launch marketing plans will be much more focused and efficient. After all, why market to consumers definitely not interested in buying your new product?

New initiative tracking―typically a highly manual, thankless task―usually assigned to a junior member of the brand team, will be transformed by digital platforms. In the new world, new initiative tracking will be highly automated, and just another total business driver. Brand teams will know how much innovation is driving their overall business, the key drivers of innovation performance, and the best levers to pull to improve results. New tools will give people the ability to simulate alternative marketing spend scenarios before actually pushing the button to adjust launch plans on the fly.

Harnessing Disrupting Innovation for Better Results

These four forces―large data sets, digital platforms, adaptive targeting, and e-commerce innovation platforms harnessed through new disrupting innovation tools―are changing the “how’s” of traditional 3D innovation. Companies will always discover, develop, and deploy new product initiatives. But if they want to advance beyond the 85% failure rate of today, they’ll need to embrace these technology disruptors to their advantage.

Disruptive new products disrupting new product development―let the “meta-disruption” begin!

Business & Finance Articles on Business 2 Community(71)