Discounting has become a widely used practice within the tech community — and many SaaS companies are suffering because of it.

For many sales reps, discounting is an easy way to close a deal, especially towards the end of the year when hitting quota is the number one thing on their mind. But whether it’s pulled out as a last-minute cherry-on-top to persuade an opportunity to buy, or a demand made by a prospect as a caveat for purchase, discounting is hurting your company in more ways than you know.

Discounting is Catastrophic to Your Fundamental Metrics

According to Merriam-Webster’s Dictionary, the definition of discounting is:

1. to lower the price of (a product)

2. to think of (something) as having little importance or value

So in essence, by offering a discount on your product, you’re detracting from the value of your product. This distracts from the reason your prospect wanted to buy in the first place and may even cause them to question whether it’s really worth the money they’re paying.

We could go on all day about why you shouldn’t discount, but let’s focus on the measurable reasons — the metrics. Let’s look at what a 20% discount across the board does to different business metrics.

Monthly Recurring Revenue (MRR)

For SaaS companies, your MRR is what sustains you. Your customers are often on a time-based subscription so you’re counting on that recurring revenue to keep your company afloat.

This means if you offer a monthly subscription, every month you’re feeling the pain from the discount. Your MRR will be less than it should be and you have less cash flow to pump back into your business.

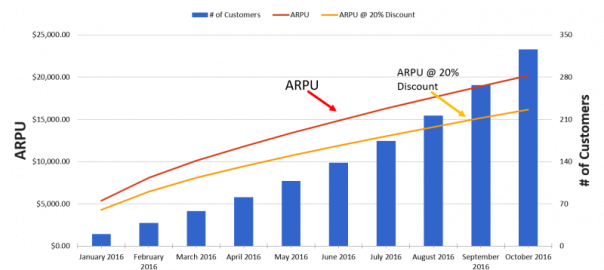

This problem is more pronounced when we translate MRR into ARPU, Average Revenue per User. This is the average monthly revenue you receive per user. It takes into account the base MRR, but also upgrades and downgrades from your customers.

In this scenario, base MRR is $ 10,000 per customer. To reach an ARPU of $ 15,000 through upgrades it takes about 270 customers on a discounted plan. On a normal plan that only requires about 140 customers. That’s almost 2x the number of customers. It also takes the company three more months to meet this ARPU when a discount is given.

This delay in revenue severely stunts the growth potential of your company and limits your ability to give as much attention to each account, as you’re handling more customers.

Lifetime Value (LTV)

Your customer’s LTV is how much revenue you get from them over the course of their lifetime with your product. Ideally, you want to increase this LTV faster so they can repay the CAC and you can begin to turn a profit quickly on each customer.

The problem here lies in the fact that when quotas need to be met, discounting occurs, decreasing the LTV of each customer and elongating the payback period. It takes longer to make up the investment in bringing on a customer when there is less revenue per customer.

Let’s show an example with our model SaaS company from above. Customer Lifetime Value (CLTV) can be calculated using the equation:

This shows that CLTV is based on ARPU and churn rate. Assuming this SaaS company has an “acceptable” churn rate of 7%, which doesn’t change based on the discount, we see that the discount artificially lowers the CLTV.

It again takes about 2x the customers and three more months to reach a CLTV of $ 200,000 with a 20% discount, compared to regular pricing. In reality, the churn rate will likely be higher as your customer values your product less because of the discount, making this gap even larger.

As Patrick Campbell, CEO of SaaS metrics company ProfitWell, puts it,

“Discounts are the laziest path to a customer conversion and have serious ramifications for your SaaS unit economics over the long term — to the point of reducing SaaS LTV by over 30%.

It just isn’t worth it.

Negative Churn

One metric that is not often tracked, but is important to keep your eye on, is negative churn. It encompasses two things: expansion revenue and churned revenue. Expansion revenue is when your customers are spending more on your products or services this month than they were last month. Churned revenue is the money you’re losing when customers churn out. Negative churn is when expansion revenue outpaces churned revenue so your company is still growing even though you’ve lost customers.

It can be calculated with this formula:

The best way to increase your negative churn is to scale up your current customers to a higher plan. But with customers who are on a discounted plan, you need to scale up just to get them on the same level as the customers who pay your full rate. Not only are you setting yourself up for more work ahead, but you’re also getting paid less for it. And why work more for less money?

In our model, we set MRR expansion per customer rate and MRR churn rate equal at 10%. We see that offering a discounted price depresses the net MRR at a growing rate over time. By October, you’re losing out on about $ 300,000 in net MRR. In reality, MRR churn rate will likely be higher and expansion rate lower, making this difference even larger.

Discounting can severely affect your metrics and revenue. Unfortunately, your reps aren’t thinking about this when chasing opportunities to fill their quota. So it’s up to sales leaders to keep this front-of-mind and develop alternatives to avoid discounting.

There Are Alternatives at Every Stage

Luckily, there are alternatives to prevent having to result to discounting. Sales Leaders can train reps to be prepared for any situation and redirect the call if discounting is mentioned. While your opportunities may be adamant, by focusing on the value you can redirect the conversation towards a more constructive negotiation. Here are some tips for avoiding discounting at every stage of the sales process.

Design Your Pricing Before the Call

Ideally discounting won’t even be an issue with a strategically designed pricing model. A model based on value metrics means your customers are paying for how much they’re using, such as the number or videos or licenses required. Using value metrics has many benefits:

- Customers are paying for what they need. By aligning your metric with your customer’s needs, they see exactly how much benefit they’re getting.

- It’s easy (and valuable!) to scale up. As your customer sees the value of your product, they can upgrade to a larger plan to get more value. This also increases their LTV and your MRR in the process.

- Customers can start on a lower plan. This way they aren’t paying as much, but they’re also getting less. You’re getting paid for as much as you’re putting in.

Value metrics save you time and effort by making sure you’re getting paid for as much work as you need to put in.

Focus on Value in Early Stage Calls

If an opp is asking for a discount during one of the first phone calls, it’s most likely a way to end the phone call as quickly as possible and stop the selling process cold. The best ways to turn this around are to:

- Focus on the value your product provides for their company. This is why they were interested in your product in the first place and will keep them hooked.

- Emphasize how you can help them. Your product is helping them solve a pain point, and you need to keep the conversation focused on that benefit.

It’s still too early to worry about pricing, so you can leave that for a later conversation. By keeping the conversation focused, you’ll help them realize that the benefits are worth the money.

Deep Dive Into Issues in Late Stage Calls

If discounting is brought up later on in the sales process, that usually means there’s a more serious issue that’s come up. They’ve already made it this far without caring about the price, so something must have changed.

The best way to go about this is to ask questions and figure out why it’s suddenly become an issue. Once you find out the reason, you can devise a way to prove the value of your product to counteract that. Here are a few common reasons discounting is brought up, and ways to work around them:

- They “can’t afford it” or it’s “too much of a risk for the company.” A few hundred, or even a thousand dollars will not make a difference compared to the benefits your product provides. Compare the ROI on your software to their Average Sales Price (ASP) to justify the price rather than bringing it down with discounts.

- They “don’t feel like it’s worth the price.” Of course, you should focus on selling the value of your product but you can also introduce as many non-monetary points of negotiation as possible. These negotiating factors can include a shorter contract agreement, mention of their company in your blog, or concessions on certain contractual terms.

- They “don’t have the last say” or “can’t make the final decision.” Honestly, you shouldn’t even be talking to someone who doesn’t have the final say in the first place. In this case, you need to ask for contact information for someone who can make the final decision and speak with them instead.

After The Discount Is Already Given

What about for the customers that you’ve already given a discount to? Maybe your convincing didn’t work and they were a high-quality opportunity that you just couldn’t lose. Or they’re a long term customer who you discounted in the past, but are now not providing enough returns.

While you can’t increase the price on their current plan, it still is possible to scale them up and increase your negative churn that way. The best ways to do that are:

- Upsell with enhanced features. By providing a “premium” service, such as more interaction or more detailed reports, they will be more willing to pay more for special features.

- Cross-sell with another aspect of your product. As a software company, there is often more than one aspect to your product. Your customers may not even know the full span of the features you offer. If they realize you can help solve more than one pain point, they may be more willing to pay more for more features.

By scaling up your current customers, you can build longer lasting relationships and turn them into loyal customers.

It’s Impossible to Avoid (Unfortunately)

There are definitely situations where discounting may be hard to avoid — such as building life-long partner relationships with customers or removing friction from the sales process. But that doesn’t mean there’s nothing you can do about it!

Here are some strategies to make sure that you don’t lose too much MRR, and keep your product value front-of-mind:

- Only enter negotiations when you have an agreement on principle. This means making sure that your opp realizes that your product solves a crucial problem for them and that this problem is worth the financial investment to solve. It’s important not to get side-tracked from the reason they were looking at your product in the first place.

- Only give up something if you’re getting something else of equal or greater value in return. If you’re lowering the price for them, they need to be returning the favor. This can include anything from a referral to another likely customer, to signing earlier so you can meet your end-of-quarter goals, to agreeing to be used in a case study.

- Only agree to a trade-off, not a concession. Don’t give in or give up just to close a deal. Make sure you’re getting something in return and maintaining an equal balance.

Slow Down — Discounting is Not Always the Answer

It’s easy to get caught up in the desperation to close a deal and just agree to a discount. Slow down. Think it over. And take the time to convince your opportunity (and yourself) that your product is worth the time and money.

At every stage, there is always an alternative to discounting. Keep the conversation focused on your product value and how you can solve their pain points. Make sure the relationship remains balanced and that you are both getting equal value. This way you keep your customers and your wallet happy.

Business & Finance Articles on Business 2 Community(81)